Michael Lee-Chin’s Laws for Wealth

When it comes to building wealth, learning from successful individuals can provide invaluable insights. Billionaire Michael Lee-Chin, known for his success in buying, turning around, and growing businesses, has shared the wealth-building laws that have given him the upper hand in business deals. This blog post will explore these laws and discuss how they can help you determine if you are on the right path to building wealth.

#1 Own a few high-quality businesses:

According to Michael Lee-Chin, owning a few high-quality businesses is crucial for building wealth. Instead of spreading your investments too thin, focus on a select number of businesses that have a proven track record of success. These businesses should have a strong competitive advantage, solid financials, and growth potential.

#2 Thoroughly understand the businesses you own:

Understanding the businesses you own is vital for making informed decisions. Take the time to thoroughly research and analyze each business in your portfolio. Understand their business models, products or services, competitive landscape, and financials. This knowledge will empower you to make strategic decisions that can drive growth and profitability.

#3 Invest in businesses in vital growth industries:

Investing in businesses operating in vital growth industries can provide significant opportunities for wealth creation. look for industries that are poised for long-term growth, such as technology, healthcare, renewable energy, and merging markets. By investing in businesses operating in these industries, you can benefit from their growth potential and increase the value of your portfolio.

#4 Use other people’s money prudently:

Using other people’s money, such as loans or investments, can be a strategic way to finance your business. However, using this capital prudently and carefully managing your debt is essential. Avoid excessive leverage that can lead to financial risks and have a solid repayment plan. Using other people’s money wisely can amplify your returns and accelerate your wealth-building journey.

#5 Have a history of holding those businesses while they continue to appreciate:

Holding onto your businesses for the long term can be a key strategy for wealth building. Avoid a short-term mindset and focus on the long-term potential of your businesses. Successful businesses tend to appreciate value over time, and holding onto them can allow you to benefit from their growth. Avoid the temptation of selling too soon and be patient in realizing the full potential of your investments.

Michael Lee-Chin’s wealth-building law can provide valuable guidance for those looking to build wealth through business ownership. By owning a few high-quality businesses, thoroughly understanding them, investing in vital growth industries, using other people’s money prudently, and holding onto businesses for the long term, you can increase your chances of success in building wealth.

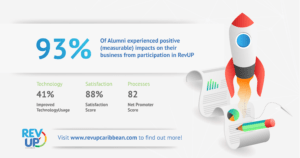

If you want to learn more about Michael Lee-Chin’s business laws and how to apply them to your own wealth-building journey, consider signing up for the RevUP Caribbean Business Incubator program. This program offers mentorship, coaching, and resources to entrepreneurs in the Caribbean region, helping them accelerate the growth of their businesses and create lasting wealth. Don’t miss out on this opportunity to gain insights from successful business leaders like Michael Lee-Chin and take your entrepreneurial endeavors to the next level. Remember, building wealth through business ownership requires careful planning, strategic decision-making, and a commitment to long-term success. By applying these laws and seeking guidance from experienced mentors, you can increase your chances of success and achieve your financial goals. Start on the right path toward building wealth today!